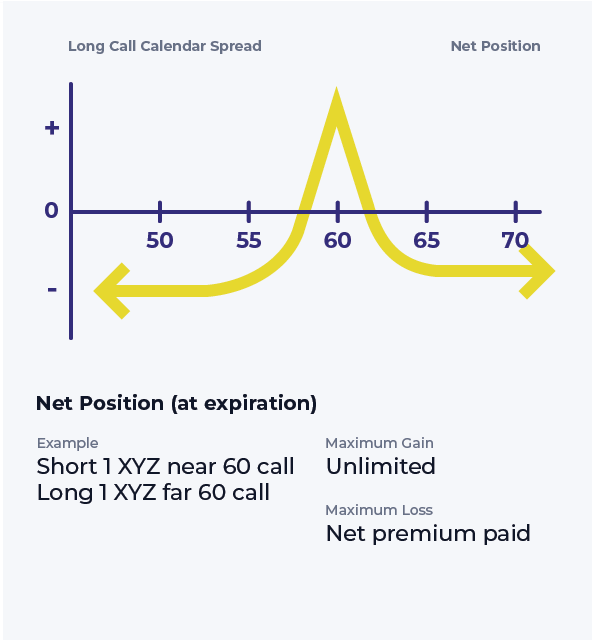

Long Call Calendar Spread - Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than. Web about long call calendar spreads. Web long calls have positive deltas, and short calls have negative deltas. The net delta of a long calendar spread with calls is usually. Web the long call calendar spread (or ‘long horizontal spread’ or ‘counter spread’ or ‘time spread’) is a neutral/slightly bullish. A calendar spread involves buying and selling the same type of option (calls. Now we're going to look specifically at. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later.

How to Trade Options Calendar Spreads (Visuals and Examples)

The net delta of a long calendar spread with calls is usually. Now we're going to look specifically at. Web long calls have positive deltas, and short calls have negative deltas. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than. A calendar spread involves buying and selling the same type.

Trading Guide on Calendar Call Spread AALAP

The net delta of a long calendar spread with calls is usually. Web about long call calendar spreads. A calendar spread involves buying and selling the same type of option (calls. Web long calls have positive deltas, and short calls have negative deltas. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike.

Long Call Calendar Spread Explained (Options Trading Strategies For

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than. Now we're going to look specifically at. Web long calls have positive deltas, and.

Long Call Calendar Spread Options Strategy

Web long calls have positive deltas, and short calls have negative deltas. Web about long call calendar spreads. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a long calendar spread is a neutral options strategy that capitalizes on time decay.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web long calls have positive deltas, and short calls have negative deltas. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than. A calendar spread involves buying and selling the same type of option (calls. Now we're going to look specifically at. The net delta of a long calendar spread with.

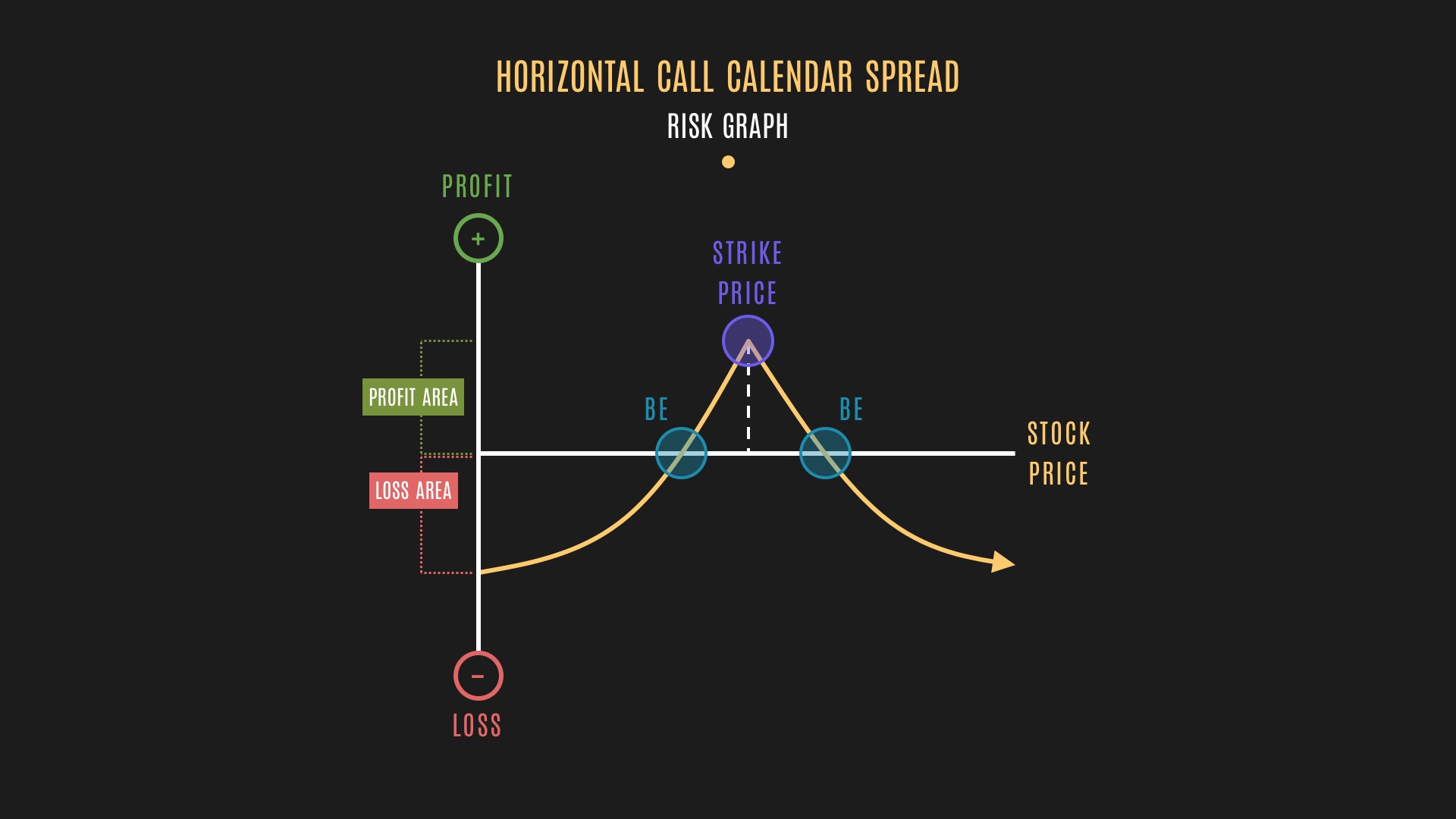

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Now we're going to look specifically at. Web long calls have positive deltas, and short calls have negative deltas. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than. A calendar spread involves buying and selling the same type of option (calls. Web a long calendar call spread is seasoned option.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web long calls have positive deltas, and short calls have negative deltas. The net delta of a long calendar spread with calls is usually. Web about long call calendar spreads. Now we're going to look specifically at. Web the long call calendar spread (or ‘long horizontal spread’ or ‘counter spread’ or ‘time spread’) is a neutral/slightly bullish.

Long Calendar Spreads Unofficed

The net delta of a long calendar spread with calls is usually. Web about long call calendar spreads. Web the long call calendar spread (or ‘long horizontal spread’ or ‘counter spread’ or ‘time spread’) is a neutral/slightly bullish. A calendar spread involves buying and selling the same type of option (calls. Web long calls have positive deltas, and short calls.

Web long calls have positive deltas, and short calls have negative deltas. Web the long call calendar spread (or ‘long horizontal spread’ or ‘counter spread’ or ‘time spread’) is a neutral/slightly bullish. Now we're going to look specifically at. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A calendar spread involves buying and selling the same type of option (calls. Web about long call calendar spreads. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than. The net delta of a long calendar spread with calls is usually.

Web A Long Calendar Spread Is A Neutral Options Strategy That Capitalizes On Time Decay And Volatility, Rather Than.

Now we're going to look specifically at. Web the long call calendar spread (or ‘long horizontal spread’ or ‘counter spread’ or ‘time spread’) is a neutral/slightly bullish. A calendar spread involves buying and selling the same type of option (calls. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later.

Web About Long Call Calendar Spreads.

The net delta of a long calendar spread with calls is usually. Web long calls have positive deltas, and short calls have negative deltas.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)